Retiring CEO Gelsinger set Intel’s INTC 0.00%↑ path for the next few years. Despite the Board as a headwind to Intel, this stock is an accumulate. Its latest CPU is a leap forward.

Flip Intel

The way I see it, the narrative about Intel's future needs to be flipped. Over the next four to five years, we'll witness process nodes and products that started under Gelsinger hitting the market. However, the real test lies beyond this period, where everything hinges on who the board brings in. Given the board's lackluster track record, I’m not too hopeful.

Let's talk about the board. It's far from impressive. Most members lack technical expertise, and those responsible for Intel's current state are still on board. For instance, Boeing's EVP of operations heads the audit committee and has been there throughout Intel's turmoil. Boeing itself has seen better days, making this appointment even more questionable.

Board Needs to Be Replaced

The board's composition is quite perplexing. It includes many members from Medtronic, individuals with medical backgrounds, and what appears to be a professional board member. One might argue that a group of semiconductor professionals would manage Intel far better than the current setup.

The most senior board members, who bear significant responsibility for the company's struggles, are still in power. The former chairman remains on the board and should be fired. The absence of semiconductor experience is glaring, with only one person possessing industry knowledge, and they joined just this year. This board is a disaster, and it's a case of the blind leading the blind. This is a significant factor in Pat's firing; the board doesn't know what it's doing. While Pat had his faults, it's hard to see how he could have received objective feedback from this board.

Intel Research report, from $79:

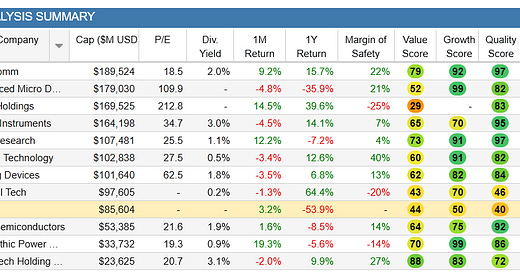

The stock grades are amber. The fair value for INTC stock is